Home Loan Denied Because it’s Not Easy Enough?

Bait and Switch?

Home loan denied because it’s not easy enough? Yes, it’s true, and it happens every day!

Qualifying for a home loan can be really easy, or not easy enough.

Every day I get questions and comments from folks from all over the Country that had their home loan denied because it wasn’t easy enough. Sometimes, these questions are actually very complex, and the answers are even more complex.

More common, however, is that most of the questions are very easy, and the answers are even easier. In most of these cases, they do qualify, and they should have never had their home loan denied!

Why Does This Happen?

I know this sounds really crazy, but the majority of questions that I get on this site are the result of an inexperienced or lazy loan officer giving misinformation to consumers.

Either they don’t know the answer and are afraid to tell you, or they do not know the answer and because they don’t know, it’s not easy enough for them to want to do it.

Probably the thing that upsets me most is that these big box lenders spend so many millions of dollars trying to convince you how easy it is to get a home loan, when in fact they are the least prepared to help if there is even the slightest issue that comes up during underwriting.

Yes, this is a kind of bait and switch. They bait you in with promises of a simple, automated process, when in fact you still have to qualify using the same underwriting programs and application process that every single lender on the planet has to follow.

The lie is that they’ve “simplified” the process in some way. That’s simply a misrepresentation.

You Get What THEY Pay For

If you’re calling off of a paid advertisement, there’s close to a 100% chance that your question is being answered by someone sitting in a call center somewhere whose job it is to get your credit card, and have your credit run.

The biggest offenders, and the most disturbing of all of these reasons is that big box lenders simply doesn’t care about hiring experienced and knowledgable loan officers. It doesn’t fit their business model.

Big box lenders are spending millions of dollars to make you think that qualifying for a home loan is as easy as downloading an app, or pushing a button and getting a loan.

Need a Second Opinion? Click Here for Help!

This kind of business model depends on being able to do a very high volume of really easy loans. These companies don’t have the experience, or the programs to help normal people that have normal, every day situations.

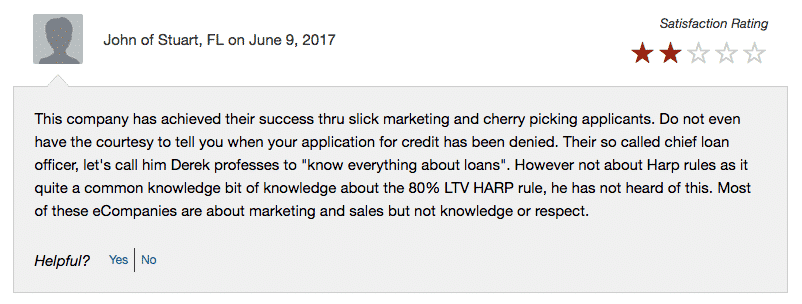

Here is an online review from a consumer that couldn’t have said it better….

Home Loan Denied in Error

When you’re being jerked around by a call center loan officer while trying to refinance your current home, that’s frustrating as hell, and will make you want to pull your hair out before it’s done.

Now imagine that you’re in the process of buying a home. The clock is ticking, the seller is counting on you to close on time, you have deposit money in jeopardy, and you’re trying to work with a company that has just convinced you how easy it is to apply for a mortgage.

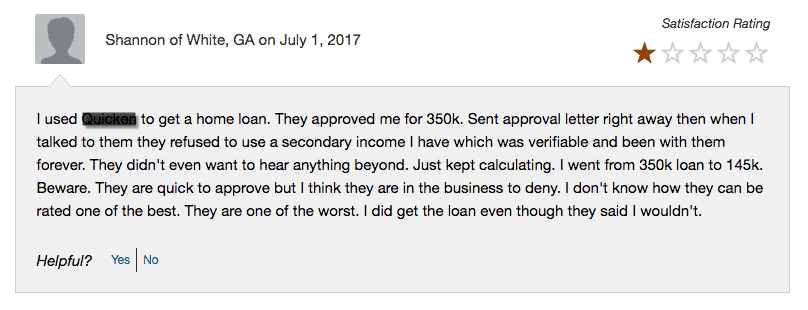

Here’s an example of an online consumer review where a big box lender didn’t know how to calculate income from a second job. This consumer ended up going to another lender and had no problem getting their loan approved and closed.

Luckily they were able to save this deal, but it sounds like it was dicey there for a while.

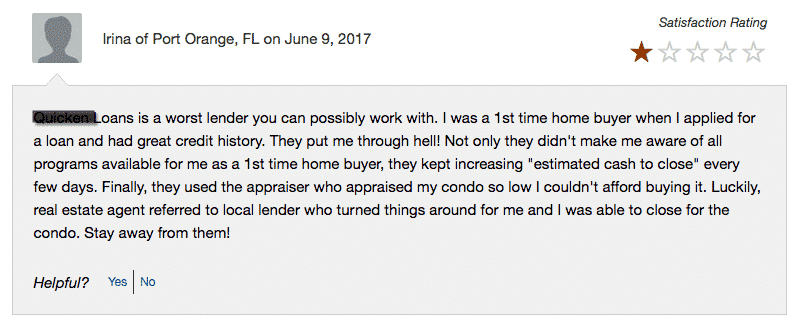

Now imagine that you’re a first time homebuyer. You get suckered into the promise of a home loan being “push button” easy, and complete transparency, and this is your experience. Again, this home buyer was able to find another lender that knew what they were doing and they were able to buy their home.

Don’t take my word for it, a simple search of consumer reviews from these types of companies will show you that it’s not just my experience, this stuff happens every single day! Here are more examples from www.consumeraffairs.com.

Set Yourself Up for Success

The absolute best thing you can do to ensure a smooth, stress free home buying experience is to work with a professional loan officer.

Once you find an expert loan officer that you trust, ask them for an introduction to a local real estate agent that they trust. Even if the loan officer is not from the community that you’re buying in, they will still be able find an agent that rises to the level of professionalism you deserve.

Not sure where to find a professional loan officer that you can trust? You’re in the right place!

Have Mortgage Questions? We Can Help! Click Here

If you have any questions or comments about this topic, feel free to leave a comment below, or you can shoot me an email at questions@findmywayhome.com.

Now sure how to identify a professional loan officer? Watch these expert interviews I’ve done with professional loan officer friends of mine.

I firmly believe that once you hear how a professional loan officer communicates, it will help you to avoid silly mistakes and errors that are common with inexperienced or uneducated loan officers.

Thank you, Scott, for helping us find a mortgage company that could help us when a “big box” mortgage company failed us.

My pleasure Paula! I’m happy to help 🙂